Learning how to prepare your finances to launch your VA business is one of the best things you can do when you are starting out. Starting a business is scary. Starting a business knowing that you want to quit your 9-5 in six months is even scarier! You have to not just make money each month, but make enough to replace your current job. And when you get started, that is something that takes some time to do. While it sounds super appealing to quit your job and be your own boss, leaving a steady income to start your own business can be hard if you haven’t done it before. That is why it’s important to do everything you can to set yourself up for success before you launch!

Know Yourself

It’s just as important to know yourself and your dream business, as it is to know the technical skills needed. Think about your motivation. Is it to replace your full-time job income? Or do leave your 9-5 and work part-time from home? Or are you a stay-at-home mom looking to add an extra $2500 a month?

And consider how you handle situations. Running a business isn’t easy – there are going to be some hard days, and some great days. What does success look like to you? How do you handle failure? How much risk are you willing to take as you work to get your business off the ground?

Know Your Schedule

Chances are, you are going to be juggling a full-time job along with your new business. And I would be lying if I said that was easy, or there was an easy way around it.

You simply have to put in the extra hours to get started.

When I started my VA business in 2018, I had a full-time job. I would work on Ava And The Bee in the evenings and on weekends. That meant I worked late some nights. And that meant I worked all weekend long, without days off. Check out this post about how to stay productive working from home!

How many hours do you want to work each week? What times will you be available for clients to contact you?

Know Your Finances

One mistake I see a lot of new creative virtual assistants make is that they expect to make $10,000 in their first month. While that sounds amazing, that doesn’t just happen.

If you only have 30 hours per month to work on client tasks and charge $30/hour, you are going to make $900 per month. Which is a great start!

The goal is to slowly ease into your financial goal.

In order to keep this transition manageable, especially if you have a full-time career at the time, I recommend having a monthly money goal.

Each month, raise this goal a few hundred dollars until you are at your ideal monthly goal. This will increase the hours you work per month, but as you get used to it, you will start to adjust accordingly. This might mean setting aside some weekends to work and complete tasks.

You don’t want to take on 20 hours a week of work at first if you are working full time as well. This will just burn you out.

For example, if you want to take home $2500 per month, you need to have a total income of at least $3550 to take taxes & monthly expenses into account.

To explain what I mean, I am going to share my personal journey with you.

When I got started my long-term goal was $2000 per month. I knew that if I was able to make $2000 per month, I would be able to pay my bills and buy what I needed.

Each month I raised my income goal. This let me know how many more clients/how many more hours I needed to work.

So I broke down my goal for the next 6 months. I started with wanting to make $800 my first month and moved it up each month.

In the second month, my goal was $1000. In the third month, my goal was $1200. In the fourth month, my goal was $1400. In my fifth month, my goal was $1800. And my final goal was $2000.

This goal planning helped assure me that I would be able to quit my full-time job within 6 months!

Have a Reasonable Goal

When it comes to goal setting, It’s important to give yourself a reasonable goal. While making $2000 a month in your first month would be amazing, that would also require you to work more hours than you might be able to. It would require you to work 66 hours per month at $30/hour, and 16 hours per week. So be reasonable with what you are able to take on each month!

There is nothing worse than being burned out before you even get your business off the ground.

How To Prepare Your Finances to Launch Your VA Business

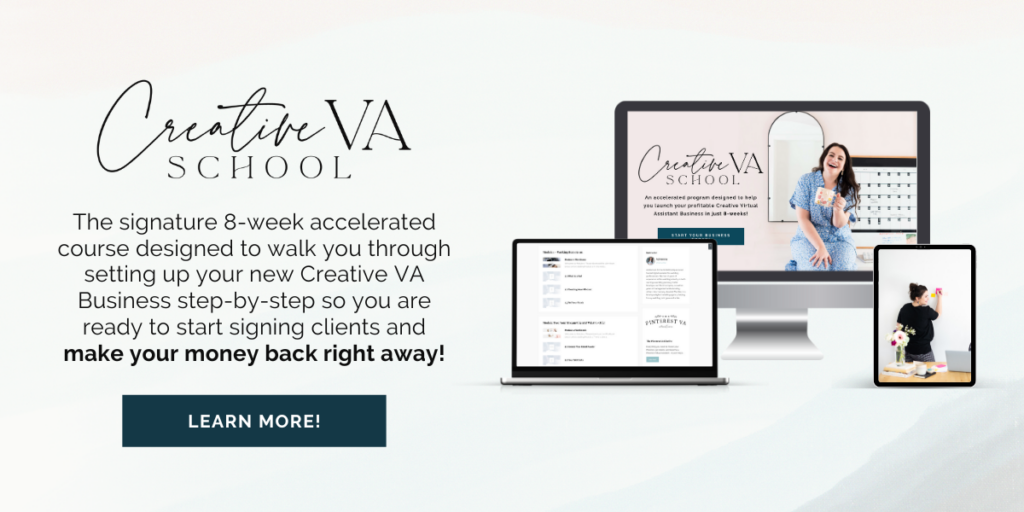

With all that being said, all the hard work you put into your business is going to pay off long term and if you take the time to prepare your finances to launch your VA business, you will make it work! Keep focusing on your long-term goal of being your own boss, or quitting your 9-5 job, and use that as motivation to keep you moving forward during those first few months. If you are looking to get your creative VA business up and running – check out The Creative VA School! This is the first – and ONLY – course designed for Creative Virtual Assistants. Since 2019, over 200 students have started and grown their dream creative virtual assistant business.